Is Exness Broker Regulated?

When it comes to choosing a brokerage for trading, one of the most critical factors to consider is regulation. The trustworthiness and safety of a broker can significantly impact your trading experience. So, is Exness broker regulated? This question is at the core of understanding whether Exness is a reliable choice for investors. In this article, we will explore the regulatory status of Exness, the importance of trading with a regulated broker, and how it affects your investing experience. For more detailed information, you can also visit is exness broker regulated https://latam-webtrading.com/en/exness-bangladesh/ that provides further insights into Exness services in Bangladesh.

Understanding Regulation in Forex Trading

Regulation refers to the supervision and control that financial authorities impose on brokers to ensure they comply with certain standards of conduct. These regulations are designed to protect traders from fraud, ensure the integrity of financial markets, and promote fair trading practices. In the Forex industry, a regulated broker is usually viewed as a safer option because they are obliged to meet specific requirements that protect their clients’ interests.

Is Exness Regulated?

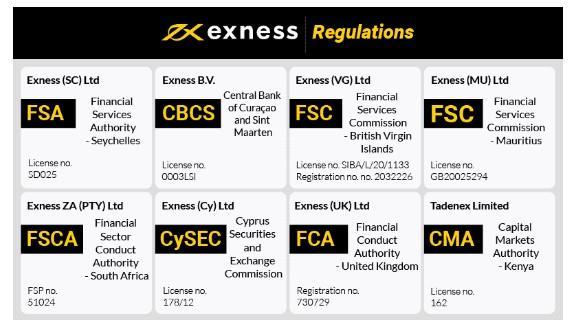

Yes, Exness is a regulated broker. It operates under several regulatory authorities, providing a level of trust and security for its traders. Exness is primarily regulated by the Financial Services Authority (FSA) of Seychelles and the Financial Conduct Authority (FCA) of the UK. These regulatory bodies enforce guidelines designed to protect investors and ensure a transparent trading environment. This means that Exness must adhere to strict financial standards, comply with anti-money laundering (AML) regulations, and keep clients’ funds segregated from the company’s operating funds.

Exness Regulatory Framework

Exness operates under different regulatory frameworks depending on the region in which it offers its services.

- FCA (UK): The FCA is one of the most reputable financial regulatory authorities globally. Brokers regulated by the FCA are required to follow strict rules to protect customers, including holding client funds in segregated accounts and providing compensation schemes in case of financial difficulties.

- FSA (Seychelles): The FSA of Seychelles also regulates Exness, allowing them to operate in a more flexible market. While the FSA may not have as stringent regulations as the FCA, it still provides a level of oversight that enhances investor confidence.

Why Trading with a Regulated Broker Matters

Trading with a regulated broker provides numerous benefits:

- Investor Protection: Regulated brokers like Exness must follow strict regulatory standards that protect client funds and ensure the integrity of their operations.

- Dispute Resolution: Regulatory bodies provide mechanisms for resolving disputes between traders and brokers, offering additional assurance to clients.

- Transparency: Regulated brokers are required to provide transparent information about their services, fees, and trading conditions.

- Peace of Mind: Knowing your funds are managed by a regulated entity helps traders focus on their trading strategies without worrying about the security of their assets.

Exness Trading Conditions

In addition to its regulatory status, Exness offers competitive trading conditions, making it an attractive choice for many traders. Some of the notable features include:

- Low Spreads: Exness provides low trading spreads, which can enhance profitability, especially for scalpers and day traders.

- Leverage: Depending on the trader’s account type, Exness allows leverage up to 1:2000, a feature that can amplify both potential returns and risks.

- Variety of Account Types: Exness offers multiple account types to cater to different trading styles and experience levels, from beginner to professional.

- Robust Trading Platforms: Traders can choose between the widely used MetaTrader 4 and MetaTrader 5 platforms that offer advanced trading tools and features.

Conclusion

In summary, Exness is indeed a regulated broker, operating under trustworthy financial authorities, which ensures a level of safety and reliability for its traders. Trading with a regulated broker like Exness provides numerous benefits, including investor protection, greater transparency, and robust trading conditions. If you’re considering opening an account with Exness, rest assured that you are engaging with a broker that prioritizes regulatory compliance and client safety. Always remember to do your research and understand the implications of trading leverage and market volatility in your trading journey.