Essential Forex Trading Strategies for Beginners

Entering the world of forex trading can be overwhelming for beginners, especially with the myriad of strategies and techniques available. However, understanding a few key strategies can greatly enhance your trading proficiency and confidence. In this article, we explore essential forex trading strategies for beginners. These strategies are designed to help you grasp the fundamentals of forex trading and set a solid foundation for your trading career. You can further explore forex trading strategies for beginners Forex Trading Platforms that might suit your trading style and preferences.

1. Understanding Forex Market Basics

Before diving into specific strategies, it is crucial to understand the fundamentals of the forex market. The forex market is a decentralized global marketplace where currencies are traded. Unlike stock exchanges with a physical location, forex operates through electronic networks. Prices fluctuate based on supply and demand dynamics, macroeconomic indicators, and geopolitical events. Familiarizing yourself with these concepts will provide context for why and how different strategies work.

2. Technical Analysis

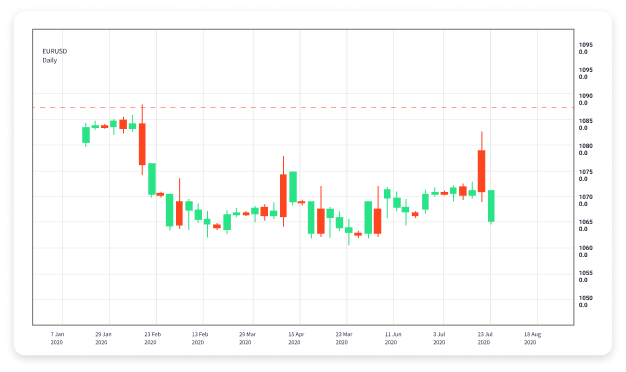

Technical analysis is one of the most popular strategies among forex traders, especially beginners. It involves examining historical price movements through charts and using indicators to predict future price movements. Common tools used in technical analysis include:

- Moving Averages: These smooth out price data to help identify trends over a specific period.

- Relative Strength Index (RSI): This momentum oscillator helps determine overbought or oversold conditions.

- Support and Resistance Levels: These are price levels where a currency pair tends to stop and reverse, indicating possible entry or exit points.

By mastering technical analysis, beginners can make more informed trading decisions and better anticipate market movements.

3. Fundamental Analysis

Fundamental analysis involves evaluating currencies based on economic indicators, news, and events that can affect currency values. Beginners should pay attention to:

- Economic Reports: Reports such as Gross Domestic Product (GDP), unemployment rates, and inflation rates can significantly influence currency values.

- Central Bank Policies: Decisions made by central banks regarding interest rates and monetary policy can impact currency movements.

- Political Events: Elections, trade agreements, and geopolitical tensions often result in volatility in the forex market.

Integrating fundamental analysis with technical analysis can provide a more comprehensive approach to forex trading.

4. Risk Management Strategies

Effective risk management is crucial for any forex trader, especially beginners. Here are some essential risk management strategies:

- Setting Stop-Loss Orders: This is a predefined price level at which you will exit a losing trade to minimize losses.

- Managing Leverage: While leverage can amplify profits, it can also magnify losses. It is important to use leverage wisely and within your risk tolerance.

- Calculating Position Size: Determine the appropriate amount to trade based on your account balance and risk level.

By implementing these risk management techniques, beginners can protect their trading capital and extend their trading careers.

5. Developing a Trading Plan

A solid trading plan is essential for trading success. It should outline your trading goals, risk tolerance, preferred currency pairs, and the strategies you will employ. Here are the components of a good trading plan:

- Trading Objectives: Define your short-term and long-term objectives.

- Market Analysis: Decide whether you will be a technical or fundamental trader or a combination of both.

- Entry and Exit Strategies: Clearly define when you will enter and exit trades based on market conditions.

- Review and Adjust: Regularly review your trading performance and adjust your plan as needed.

A well-thought-out trading plan can help beginners stay disciplined and focused, reducing the emotional decision-making that often leads to losses.

6. Practicing with a Demo Account

Before committing real money, beginners should practice their skills using a demo trading account. Most forex brokers offer free demo accounts where you can trade with virtual money. This allows you to:

- Test different trading strategies without financial risk.

- Familiarize yourself with the trading platform and its tools.

- Gain confidence in your trading abilities before transitioning to a live account.

Demo accounts are an invaluable resource for beginners and can accelerate the learning process.

7. Continuous Learning and Improvement

The forex market is constantly evolving, and so should your trading skills. Successful traders commit to continuous learning and improvement by:

- Reading books and articles about forex trading.

- Participating in webinars and online courses.

- Joining trading communities and forums to share insights and experiences with other traders.

- Keeping a trading journal to track your trades, performance, and emotional responses.

By actively seeking knowledge and adapting to market changes, beginners can enhance their trading capabilities and increase their chances of success.

Conclusion

Forex trading can be a rewarding venture for beginners who invest time and effort into understanding the market, developing strategies, and managing risks. By incorporating technical and fundamental analysis, establishing a risk management plan, and committing to continuous learning, newcomers can lay the groundwork for a successful trading journey. Remember, persistence and patience are key in forex trading. Take your time, practice diligently, and always keep learning.

Happy trading!